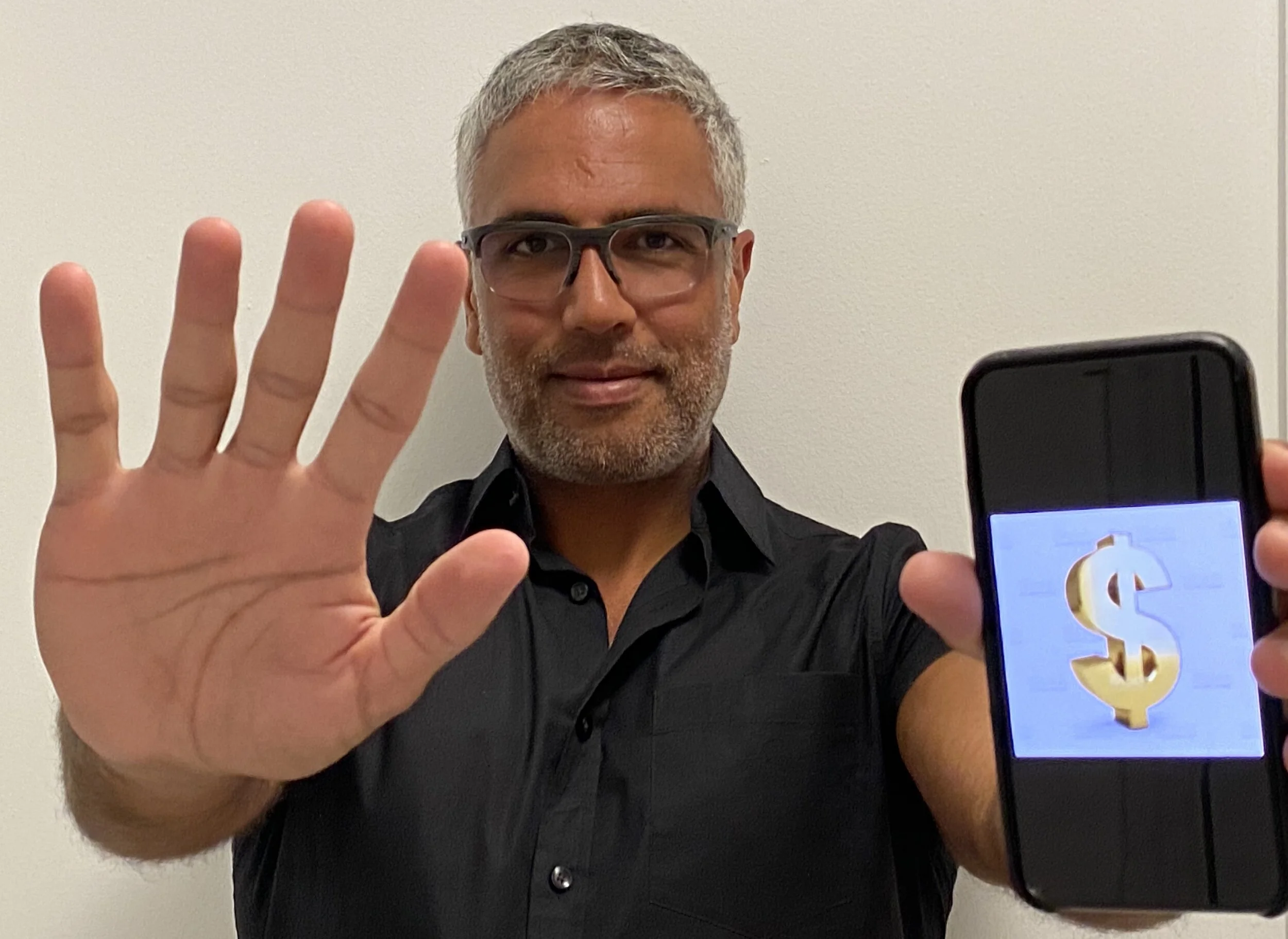

For every successful business I’ve started, or investment I’ve made, there have been multiple failures: businesses that never took off, investments that went to zero, and times when I was super gung-ho about something, only to have it end up in my Bad Idea Hall of Fame. Want to know more? Let’s take an honest trip down memory lane.

The Kickoff

The first one that comes to mind takes me back to my college years, when I was about 20. I was still in school at the time, and really into kickboxing, which was just becoming popular, with studios popping up everywhere. One day, I had a lightbulb moment for how I could monetize the kickboxing trend.

I bought the domain name Kickboxing.net with the plan of building an online directory of kickboxing studios. To fill out the front end of the site, I put up a bunch of content around the sport, but that was the easy part. The more labor-intensive work was creating the software that would pull information from a database about different locations. During my limited free time, I programmed the whole thing, spending probably about four months on it.

More …

Grantor Retained Annuity Trusts, commonly referred to as GRATs, are a financial instrument that allow a property or asset owner to pass appreciating assets to their heirs with minimal, if any, estate tax consequences. Affluent taxpayers often turn to GRATs (and capitalize on the higher estate tax exemption eligible under the Tax Cuts & Jobs Act of 2017) as part of a creative, proactive strategy in planning their estates.

So how can you benefit from a GRAT? The first step is for you, the grantor, to contribute an appreciated asset(s) to an irrevocable, fixed trust. You would then be entitled to receive an annuity from the asset during the term of the trust. Keep in mind, this annuity is not the same as the income generated by the asset. The grantor of the asset is eligible for an annuity based on the fair market value of the asset at the time it was put in trust, not simply the income generated from the asset.

More …

What are they and how can you benefit?

Real estate investors are constantly looking for new trends or the new “hot” investment. In recent years, Delaware Statutory Trusts (DST’s) have grown in popularity because of their diversification, tax planning opportunities, high-quality asset holdings, and passive nature. Delaware Statutory Trusts are an alternative investment vehicle to a traditional real estate property in a 1031 Exchange. DST’s allow investors to purchase tenant-in-common (TIC) share(s) of an investment fund. These funds can appear extremely similar to a Real Estate Investment Trust (REIT). The trust owns the property, but the investor owns a portion of the trust.

What I Am Reading

The Psychology of Money: Timeless lessons on wealth, greed, and happiness

Doing well with money isn’t necessarily about what you know. It’s about how you behave. And behavior is hard to teach, even to really smart people. Money―investing, personal finance, and business decisions―is typically taught as a math-based field, where data and formulas tell us exactly what to do. But in the real world people don’t make financial decisions on a spreadsheet. They make them at the dinner table, or in a meeting room, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together. In The Psychology of Money, award-winning author Morgan Housel shares 19 short stories exploring the strange ways people think about money and teaches you how to make better sense of one of life’s most important topics.

The Science of Wisdom

As it turns out, wisdom doesn’t vary only between people who read about hypothetical scenarios in a laboratory. Even the same person typically shows substantial variability over time. Several years back, researchers asked a group of Berliners to report their most challenging personal issue. Participants also reported how they reasoned about each challenge, including meta-cognitive strategies similar to those described above. When inspecting the results, scholars observed a peculiar pattern: for most characteristics, there was more variability within the same person over time than there was between people. In short, wisdom was highly variable from one situation to the next. The variability also followed systematic rules. It heightened when participants focused on close others and work colleagues, compared with cases when participants focused solely on themselves.

These studies reveal a certain irony: in those situations where we might care the most about behaving wisely, we’re least likely to do so. Is there a way to use evidence-based insights to counter this tendency?

More …

When most business owners hear “taxes” they either stop paying attention or only think about how much in taxes they’re going to owe. However, Research & Development (R&D) Tax Credits are something every entrepreneur & existing business owner MUST understand and utilize. Many expenses that qualify for R&D Tax Credits are expenditures that your business is already encountering which you may not be capitalizing on. Having a thorough understanding of the following rules & ideas can save your business a lot of money each year in taxes.

Let’s start by understanding the difference between a tax credit and a tax deduction. Tax credits are more valuable because they are a dollar for dollar offset of a tax liability. In contrast, a tax deduction simply reduces your taxable income before the tax rate is applied. A tax credit directly reduces your tax liability in the amount of the credit, whereas a tax deduction only reduces a portion (your tax rate) of your tax liability. Because certain R&D costs are treated as a tax credit rather than a tax deduction, the tax savings are much larger for your business.

More…

Throughout my professional career, I’ve worked hard to stay aware of technology trends & changes. My first gig in college was working for a blog publishing website – well before anyone even knew what a blog was! Since that day, I’ve been involved in many entrepreneurial tech ventures that both increased my awareness & improved my ability to evaluate opportunities. 5G Networks are a major real estate opportunity that landlords are currently overlooking and need to capitalize on.

More …

As a real estate investor and developer, I have learned that every dollar counts. Development budgets are tight and the returns on any deal are impacted by every decision. One often overlooked is the potential tax savings and planning opportunities available for a transaction. There is no better tax-saving opportunity for an investor than a Cost Segregation Study. Most investors do not fully understand the benefits of a Cost Segregation Study, and it’s amazing how few tax professionals are aware of this opportunity.

More …

Relocating From NYC to Florida? Know This Before You Take the Leap

Had a blast talking to the gracious host of the Miami Real Estate PodCast Omar De Windt from Cervera for almost an hour about:

✅ Being an Entrepreneur in NYC for almost 20 years

✅ Why I decided to move my home and company outside of NYC

✅ The logistical process of moving to Miami and going through a tough residency audit

✅ What the personal benefits of living in South Florida are and why I don’t regret one minute of moving

✅ My Predictions for NYC and Miami in the Next 10 years

✅ Why it completely sucks to be a startup entrepreneur

#Miami #NYC #RealEstate #Startups #Investing #VentureCapital #EntrepreneurLife #NemanVentures

More …

My experience in the nightlife industry while developing JoonBug showed me that every new opportunity has two sides - one that complements the status quo, and the other that opens up avenues for innovation. I see Opportunity Zones as the perfect example, because while most entrepreneurs are focused on the tax cuts offered by the program, there is also a way for businesses to earn multiple benefits by becoming the cornerstone of the initiative, relocating or re-focusing their business to these Opportunity Zones.

Opportunity Zones (OZs) are a novelty, introduced barely more than two years ago back in December of 2017 with the Tax Cuts and Jobs Act. But they’re also well-known in the sense of being a good idea turned utterly convoluted by heaps and heaps of limitations, exceptions and requirements. In fact, some say that merely understanding the inner workings of the opportunity zones mechanism is the biggest barrier for entry.

More

As sunny South Florida continues to develop into a world-class locale, and a legal tax haven, many New Yorkers are reconsidering whether the city that never sleeps is the right place in which to live and park their assets. But few know how challenging the process can be for those within a certain tax bracket… Lucky for you, I have the scoop.

I’m a New Yorker through and through – born in Brooklyn, an NYU grad, and job-creator for hundreds of locals through three different companies I founded in the city. More than 35 years later, however, I realized that perhaps the concrete jungle wasn’t the best place in which to take the next step in my career, and continue to grow my net worth. The tax burden, and exorbitant costs that come with living in one of the world’s greatest cities are steep. This is common knowledge. A lesser-known fact, however, is that it’s a massive headache to relocate from New York to a new state once you reach a certain rung on the financial food chain. The state of New York doesn’t let its prized residents flee so easily, a fact that is especially salient today as prominent figures and institutions – Icahn Enterprises, U.S. President and Queens native Donald J. Trump – are stealing headlines for relocating to Florida, just as I did in 2014.

My move was prompted by the same factor that promoted Carl Icahn and Trump’s – the math simply was no longer working out. The family I had always wanted had materialized, and as my wife and I began researching elite schools for our daughter, which were practically the same cost as a state University, the siren song of sunny South Florida began calling me. We knew we wanted a bigger family, and the financials were not making sense. While I’ve never looked back on the decision to relocate, I urge anyone considering following in my footsteps to educate themselves on what the process will entail and be both mentally and financially prepared.